ESG Data Aggregation and Management for Borrower Companies

From data collection for information disclosure,

to visualizing companies’ strengths and challenges through scoring,

and utilizing the results for structuring products such as sustainable finance—

TERRAST for Enterprise (T4E) and TERRAST for Management (T4M) provide one-stop support.

Challenges in Collecting Non-Financial Information from Borrower Companies

Data Collection Barriers

Limited understanding of ESG among companies, resulting in slow progress in data collection

Lack of Expertise

Few in-house personnel with detailed ESG knowledge, causing delays in implementation

Limits to Utilization

Non-financial data is not being fully leveraged for sustainable finance initiatives

Why Choose T4E/T4M

We provide a one-stop solution for ESG data collection, scoring, and utilization tailored to financial institutions.

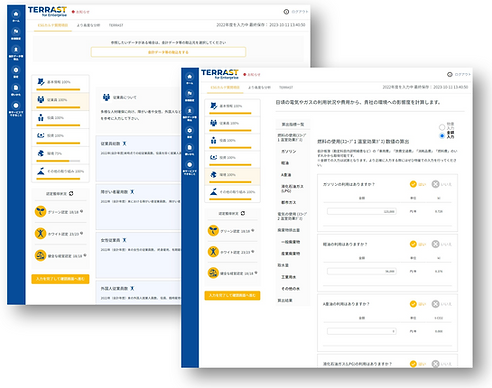

Flexible and Efficient

Data Collection

Through API integration with existing systems, OCR reading, bulk data import, and other methods, it achieves more efficient and timely environmental data collection.

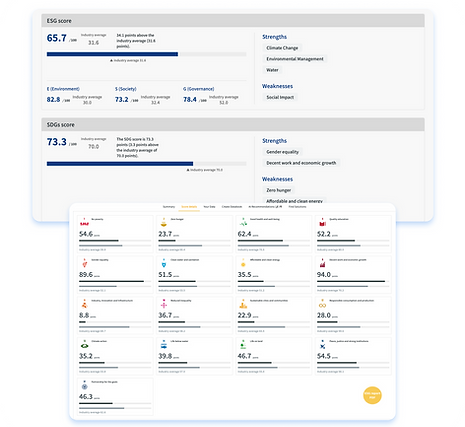

Scoring & Visualization

Benchmark against industry averages to quantify borrowers’ strengths and weaknesses, and visualize complex ESG data through intuitive dashboards.

Full Adoption Support

User-friendly UX enables operation without specialized knowledge, with ongoing support to improve utilization rates and promote adoption.

Sustainable Finance Solutions

Comprehensive support from structuring finance products based on ESG scores to launching full-scale consulting services.

Key Features & Highlights

/01

SDSC-Compliant Framework Design

Fully compliant with SDSC (Sustainability Data Standardization Consortium) standards, joined by over 70 financial institutions including Japan’s three megabanks.

Covers Environment, Social, and Governance comprehensively to enable ESG data collection that meets industry standards.

/02

Scoring & Visualization

By comparing with industry averages, you can quantitatively identify borrowers’ challenges and strengths.

An intuitive dashboard enables clear visualization, providing strong support for credit assessment and engagement activities.

/03

Support from Onboarding to Full Adoption

A UI/UX designed for ease of use, combined with comprehensive training programs.

We support the establishment of promotion frameworks from initial rollout to increased utilization rates.

Already Adopted by Many Financial Institutions

Launching consulting services

Structuring finance products

Collaborate with municipalities

Accelerate ESG management and streamline disclosures

with TERRAST powered by Uniqus

For more details about our services, demos, and inquiries, please feel free to contact us.

We constantly improve the product and expand the data coverage, functions, and collaborations to serve more clients in other regions. So it is very welcome to hear your feedback.

Please feel free to drop us your message.